The Rise of Smart Pet Products in Latin America and the Middle East: A Deep Dive into 2025 Market Trends

Date: 2025-11-26 Categories: Trends Hits: 625

The Rise of Smart Pet Products in Latin America and the Middle East: 2025 Market Trends Analysis

I. Introduction: A New Wave of “Smart Pet Parenting” in Emerging Markets

1.1 The Global Smart Pet Products Landscape

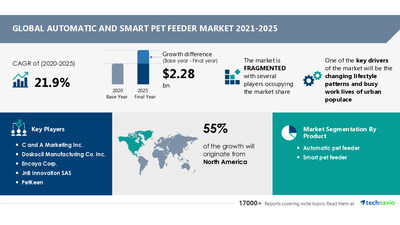

As the pet economy expands, smart pet products are a top growth driver. In 2024, the global smart pet products market reached USD 5.9 billion, projected to hit USD 35.3 billion by 2034 (CAGR 19.5%, Gongyan Industry Research Institute 2025). While North America and Europe remain strong, Latin America and the Middle East are emerging as the fastest-growing regions for smart pet tech.

North America and Europe have mature smart pet product adoption, with smart feeders and health-monitoring devices integrated into daily pet care. However, Latin America’s pet culture and rising incomes, plus the Middle East’s high purchasing power for premium pet tech, are reshaping the global market.

1.2 Core Research Value

Pet ownership has evolved from basic companionship to premium care, with pets recognized as family members. This shift drives demand for technology-empowered smart pet products, making Latin America and the Middle East critical markets for global brands. Understanding local consumption patterns unlocks opportunities for product localization and early-mover advantages.

II. Market Status of Smart Pet Products in Latin America and the Middle East

2.1 Market Size and Growth Drivers

2.1.1 Latin America: From “Pet Passion” to “Smart Pet Upgrading”

Over 40% of Latin American households own pets, with young middle-class consumers driving demand for smart pet products. The regional market is projected to reach USD 1.2 billion in 2025 (22% annual growth, BizInsights Consulting 2025), with smart feeders and automatic litter boxes leading sales in key cities like São Paulo and Mexico City.

2.1.2 Middle East: High-Net-Worth Pet Owners Fuel “Tech Luxury” Consumption

The Middle East’s affluent pet owners drive premium smart pet product demand: Dubai and Riyadh pet owners spend over USD 500 annually on smart pet devices. The Saudi Arabia and UAE market will reach USD 850 million in 2025 (25% annual growth, QYResearch 2025), with GPS-enabled smart collars (35% penetration) and climate-adapted pet pods leading growth.

2.2 Product Structure and Regional Consumer Preferences

| Region | Core Product Types | Technology Preferences | Channel Characteristics |

|---|---|---|---|

| Latin America | Smart feeders (40%), pet cameras | Value for money (USD 50–150), Spanish-localized apps | Online-dominant (Amazon LATAM 60%), community group-buying |

| Middle East | Smart collars (35%), robotic companion pets | Premium materials, multilingual AI interaction | High-end offline stores (40%), brand-site customization (25%) |

Latin American consumers prioritize affordable, practical smart pet products with Spanish-language support, while Middle Eastern buyers seek premium, climate-adapted smart pet devices with cultural compliance and customization options.

III. Three Core Growth Drivers: Technology, Economy, and Culture

3.1 Latin America: “Demographic Dividend + Digital Accessibility”

3.1.1 Youth-Driven Urban Pet Culture

Over 60% of Latin America’s population is aged 18–35, with DINK households and solo dwellers driving demand for smart pet products like auto-interactive laser cat toys (30% sales growth in 2024). These smart pet devices address emotional needs by simulating companionship for pets when owners are away.

3.1.2 Smartphone Penetration Enables Connected Pet Ecosystems

With 85%+ smartphone penetration in Mexico and Argentina, connected smart pet ecosystems (remote feeding, health monitoring) are mainstream. Local brands like Brazil’s PetTech offer 4G-enabled smart pet devices for stable performance in low-connectivity areas.

3.2 Middle East: “Policy Reform + Consumption Upgrade”

3.2.1 Social Transition and Pet-as-Family Mindset

Saudi Arabia’s Vision 2030 and UAE’s pet-friendly apartment policies drive demand for smart pet devices like odor-controlling automatic litter boxes (sales doubled in 2024). Digital pet registration also boosts adoption of smart microchip devices (40% annual growth).

3.2.2 Purchasing Power Drives Premium Smart Pet Products

Middle Eastern pet owners (USD 30k+ disposable income) prioritize high-end smart pet products like air-conditioned pet pods (USD 800) and sand-proof smart leashes, with a 45% repurchase rate for premium smart pet tech.

3.3 Shared Global Logic

Pet humanization: Smart litter boxes with waste analysis have 25% penetration in both regions, serving as core health-monitoring tools.

IoT infrastructure: 90% 4G coverage in Latin America and 35% 5G availability in the Middle East enable remote control and cloud analytics for smart pet devices.

Subscription services: Monthly health report plans (USD 10–30) create recurring revenue for smart pet product brands.

IV. Challenges and the Path to Breakthrough

4.1 Latin America: Localization and Supply Chain Bottlenecks

Latin America’s diverse climate requires climate-adapted smart pet devices (moisture-resistant for Amazon, cold-resistant for Andes). Brands like Petkit establish regional R&D labs to optimize smart pet product performance, while overseas warehouses in São Paulo reduce delivery times to 3–5 days.

4.2 Middle East: Cultural Compliance and Data Privacy

Religious norms in Saudi Arabia require “Islamic mode” for smart pet apps (hiding sensitive imagery), while UAE’s data privacy laws mandate local server storage for pet health data (AWS Middle East partnerships ensure compliance). Blockchain also secures cross-border data flows for smart pet products.

V. Future Trends: Technological Iteration and Scenario-Driven Innovation

5.1 Latin America: Value-Driven Multi-Function Smart Pet Products

2025 will see mainstream adoption of 3-in-1 smart feeding stations (feeding, weighing, health monitoring) at USD 120, plus Spanish voice-controlled pet cameras (30% market share projection).

5.2 Middle East: Premium Customized Smart Pet Ecosystems

Dubai’s 24K-gold smart collars (USD 2,000+) and Saudi Arabia’s “desert navigation mode” smart leashes reflect premiumization, with AI-driven personalized interaction for smart pet devices.

5.3 Shared Global Trend: AI × Sustainability

AI-powered behavior analysis for smart pet toys (85% accuracy) and sustainable innovations (solar-powered feeders in the Middle East, biodegradable litter box shells in Latin America) align with ESG goals and regional needs.

VI. Conclusion: A Strategic Window in Emerging Markets

Latin America and the Middle East are redefining the global smart pet products market, driven by tech penetration and pet-as-family culture. Brands must adopt regional R&D + localized adaptation: prioritize affordability and climate adaptation in Latin America, and premium customization/cultural compliance in the Middle East.

AI-enabled health management and renewable-energy smart pet devices are high-growth segments, with the combined LATAM + MEA market projected to exceed USD 5 billion by 2030—making it the global smart pet economy’s “second growth pole.”

Frequently Asked Questions (FAQ)

In Latin America, smart feeders and automatic litter boxes dominate, driven by value-conscious young middle-class consumers. In the Middle East, high-end smart collars and robotic companion pets are most popular, reflecting the region’s premiumization trend and climate-adapted requirements.

Adoption is driven by a combination of factors: in Latin America, young, tech-savvy pet owners and high smartphone penetration enable connected pet ecosystems; in the Middle East, rising disposable incomes, social policy reforms, and cultural shifts toward considering pets as family members boost demand for high-end, customized smart products.

Latin American consumers focus on affordability, practicality, and localized features (e.g., Spanish-language apps). Online channels dominate, particularly Amazon LATAM and community group buying. Middle Eastern consumers prioritize premium quality, high-tech features, and cultural compliance. Offline boutique stores and customized online offerings are key channels.

Key trends include AI-powered behavior analysis, remote pet monitoring via mobile apps, connected ecosystems, and integration with IoT infrastructure. Sustainable technologies, such as solar-powered feeders and biodegradable litter box materials, are also gaining traction in both regions.

In Latin America, climate diversity and logistics pose challenges, requiring climate-adapted designs and regional warehouses. In the Middle East, cultural compliance, sensitive content regulation, and strict data privacy laws require tailored product features and local cloud storage solutions.

By 2025, the Latin American smart pet market is expected to reach USD 1.2 billion, and the Middle Eastern market around USD 850 million. Combined, both regions are projected to surpass USD 5 billion by 2030, becoming a major growth pole in the global smart pet economy.

Success depends on a dual strategy: localized R&D and product adaptation. In Latin America, focus on affordable, practical, and climate-adapted designs. In the Middle East, prioritize premium customization, cultural compliance, and personalized experiences for high-net-worth consumers. Early investment in channels, R&D, and compliance is key to long-term growth.